The Definitive Guide for Paul B Insurance Medigap

Wiki Article

Some Known Questions About Paul B Insurance Medigap.

Table of ContentsThe smart Trick of Paul B Insurance Medigap That Nobody is DiscussingOur Paul B Insurance Medigap IdeasPaul B Insurance Medigap for DummiesThe smart Trick of Paul B Insurance Medigap That Nobody is Talking AboutFacts About Paul B Insurance Medigap RevealedAn Unbiased View of Paul B Insurance Medigap

You have actually most likely observed that Medicare is rather different from health insurance policy prepares you have actually had previously. Prior to Medicare, your strategy likely consisted of clinical and also prescription insurance coverage. And if you had wellness insurance coverage via job, you probably had dental and vision protection, as well. Original Medicare, or Medicare you receive from the government, only covers clinical as well as health center benefits.

Excitement About Paul B Insurance Medigap

Medicare health insurance plan offer Component A (Healthcare Facility Insurance Policy) and Component B (Medical Insurance coverage) advantages to people with Medicare. These plans are normally provided by personal firms that agreement with Medicare. They include Medicare Advantage Program (Part C) , Medicare Price Plans , Presentations / Pilots, and also Program of All-inclusive Care for the Elderly (PACE) .1 And since you aren't ready to leave the labor force simply yet, you might have a new option to take into consideration for your medical coverage: Medicare. This post contrasts Medicare vs.

9 Easy Facts About Paul B Insurance Medigap Explained

The difference between distinction health personal and Insurance coverage is that Medicare is mostly for mainly Americans Specific and older as well as surpasses as well as health exclusive health and wellness the number of coverage choicesInsurance coverage while private health personal health and wellness insurance policy enables dependents.

If you pick a Medicare mix, you can contrast check this site out those kinds of strategies to locate the best costs as well as protection for your needs. Initial Medicare Original Medicare (Components An and also B) supplies medical facility and clinical insurance coverage.

The Of Paul B Insurance Medigap

Initial Medicare + Medicare Supplement This mix adds Medicare Supplement to the fundamental Medicare protection. Medicare Supplement plans are created to cover the out-of-pocket costs left over from Initial Medicare.This can decrease the cost of covered medicines. Medicare Advantage (with prescription drug insurance coverage included) Medicare Benefit (Part C) strategies are often called all-in-one strategies. In enhancement to Part An and also Component B insurance coverage, lots of Medicare Benefit strategies include prescription see drug plan coverage. These plans additionally typically consist of oral, vision, and also hearing coverage.

Medicare is the front-runner when it concerns networks. If you do not intend to stay with a limited number of physicians or health centers, Initial Medicare is likely your best option. With Initial Medicare, you can most likely to any kind of supplier that accepts the national program. You can keep this adaptability if you add a Medicare Supplement plan, with the added benefit of reduced out-of-pocket costs.

The Main Principles Of Paul B Insurance Medigap

These locations and also individuals compose a network. If you make a browse through outside of your network, unless it is an emergency situation, you will certainly either have limited or no insurance coverage from your medical insurance strategy. This can obtain costly, particularly since it isn't constantly simple for individuals to know which service providers as well as locations are covered.

2 While many people will pay $0 for Medicare Component A costs, the common costs for visite site Medicare Component B is $170. 3 Components An as well as B (Initial Medicare) are the standard structure blocks for insurance coverage, and postponing your registration in either can lead to monetary fines.

These strategies won't erase your Component B costs, but they can give added protection at little to no cost. The price that Medicare pays compared to personal insurance policy relies on the solutions provided, and also prices can differ. According to a 2020 KFF research, private insurance repayment rates were 1.

6 Easy Facts About Paul B Insurance Medigap Described

5 times greater than Medicare prices for inpatient healthcare facility solutions. 4 The following thing you may take into consideration are your yearly out-of-pocket prices. These consist of copays, coinsurance, and deductible quantities. Medicare has utilize to discuss with health care suppliers as a nationwide program, while exclusive medical insurance plans work out as individual companies.

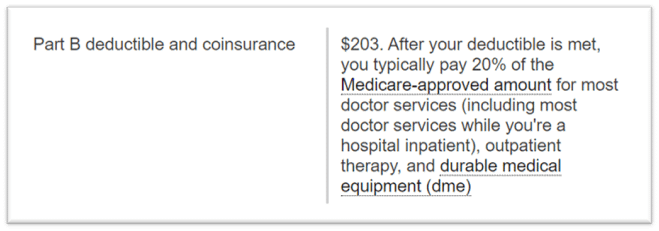

You need to additionally take into consideration deductibles when looking at Medicare vs. exclusive health and wellness insurance. The Medicare Part A deductible is $1,556.

It is best to utilize your strategy details to make comparisons. Usually, a bronze-level wellness insurance plan will have an annual clinical insurance deductible of $1,730. 6 This is a national average as well as might not show what you really pay in costs. It is best to utilize your strategy information to make contrasts.

Report this wiki page